41+ turbotax not deducting mortgage interest

If the home equity loan was for 300000 the. Web Purpose of Form.

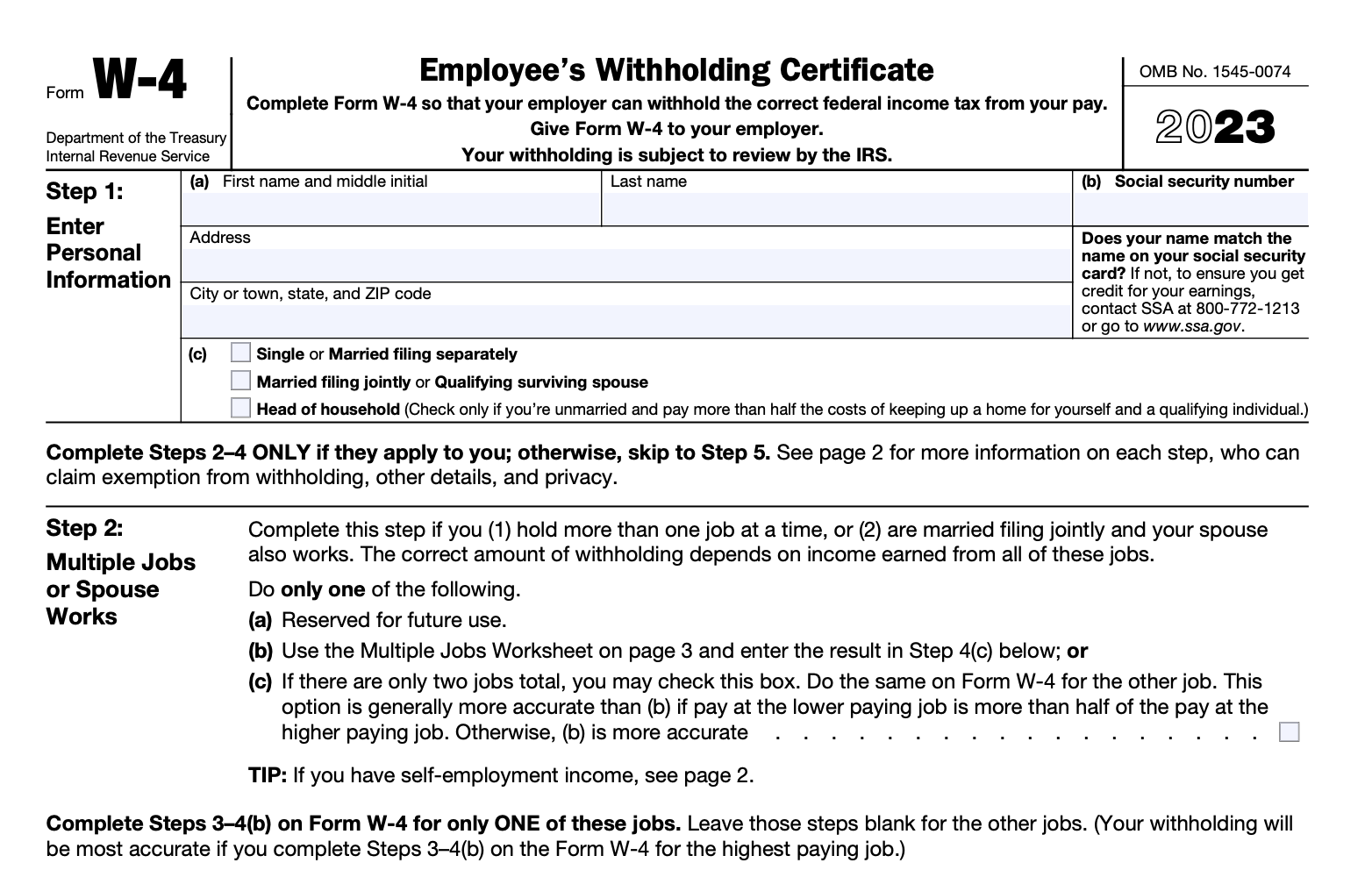

What Is The W 4 Form Here S Your Simple Guide Smartasset

Web Up to 25 cash back Because the total amount of both loans does not exceed 750000 all of the interest paid on the loans is deductible.

. Web I had the same issue with turbotax not allowing to deduct a 31K mortgage interest. The work around is rather simple. Go to Forms menu - on the top right corner of the.

No Matter What Your Tax Situation Is TurboTax Has You Covered. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 and any carryover to 2022 of amounts not deductible. You paid 4800 in. See How Easy It Really Is Today.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Web The IRS places several limits on the amount of interest that you can deduct each year. The terms of the loan are the same as for other 20-year loans offered in your area.

Tax Filing Is Fast And Simple With TurboTax.

The Irs Is Sending Special Refunds To 1 6 Million Taxpayers Money

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

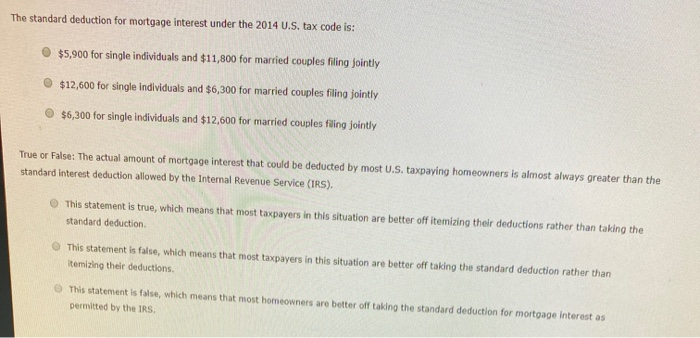

Solved The Standard Deduction For Mortgage Interest Under Chegg Com

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Genuine Tax Simplification Not Grandstanding From Senator Warren And Friends Neil H Buchanan Verdict Legal Analysis And Commentary From Justia

Mortgage Interest Deduction Changes In 2018

Home Mortgage Loan Interest Payments Points Deduction

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Reinventing Photography With A Saas Enabled Data Driven By Tom Zimberoff The Startup Medium

What Is Mortgage Interest Deduction Zillow

10 Strange But Legitimate Federal Tax Deductions Turbotax Tax Tips Videos

Solved Turbotax Premier Not Deducting Mortgage Interest On Refinanced Mortgage

10 Commonly Overlooked Tax Deductions And Credits The Turbotax Blog